Bitcoin’s Biggest Threats – Why it won’t Succeed

By Macey Hollenshead — NextEdge Strategies

Over Thanksgiving, I was challenged to write about the bear case for bitcoin. Yes, bitcoin is starting to disrupt and even integrate with the current financial system, but it won’t be valuable forever, right? Bitcoin is for criminals who want to buy black market goods, right? I will let you decide.

For years, critics have repeated the same talking points about Bitcoin’s vulnerabilities: government bans, competitive assets, or a magically “strong” U.S. dollar not inflating away hard working American’s savings. When you dig deeper, though, almost none of these narratives hold up. The uncomfortable truth, for skeptics and holders, is that Bitcoin has already passed the phase where a single flaw or event could kill it.

That doesn’t mean there are no risks. It means the real risks are completely different from the ones most people imagine. Bitcoin’s core design has proven remarkably resilient: decentralized mining, global node distribution, an immutable monetary policy, and a user base that continues to expand during every macro event. The threats people obsess over today are either technically solvable, mathematically impossible, or historically disproven.

When you strip away the noise, Bitcoin’s actual threats revolve around human behavior and macroeconomic timing.

1. Severe Global Liquidity Crises

Bitcoin performs best when liquidity expands. A deep, prolonged liquidity crunch could delay a bull cycle. Unfortunately, markets are influenced by global governments, monetary policy, and the flow of financial institutions. This is why understanding the federal reserve and words like quantitative easing “QE”, Quantitative tightening “QT”, and market liquidity truly matter from an investment standpoint.

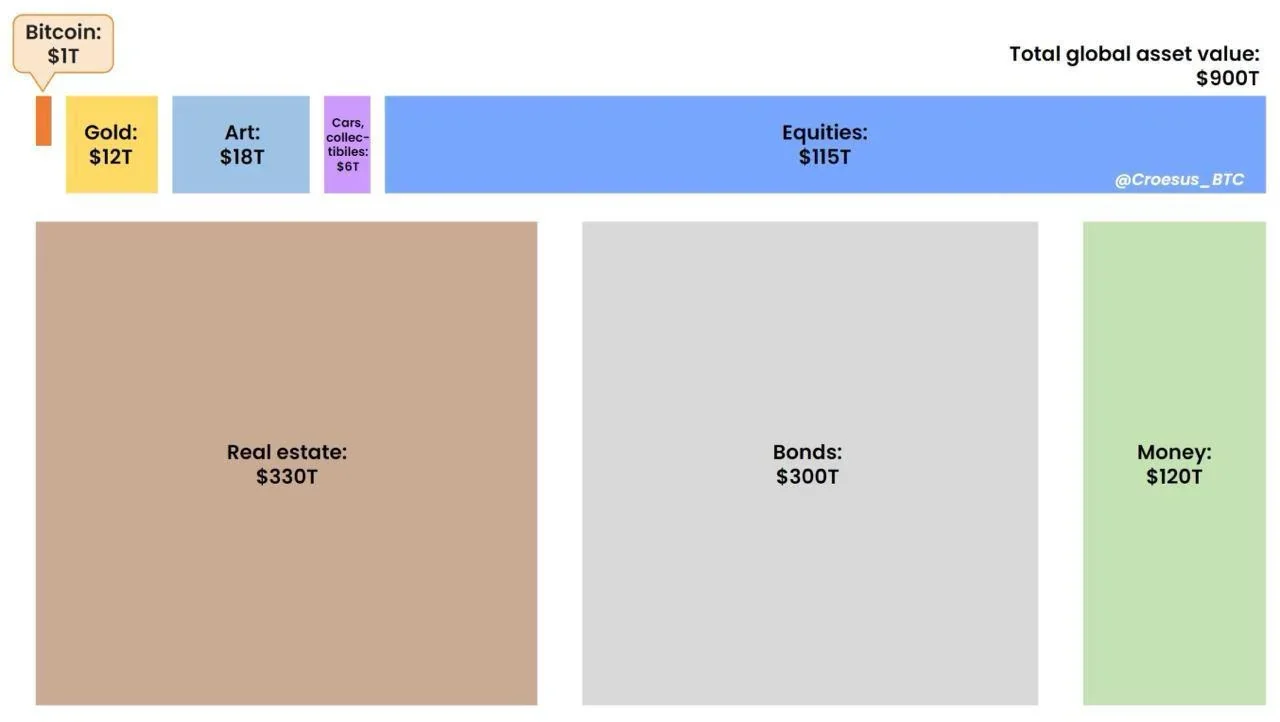

The number is disputed, but there are about 900 Trillion “dollars” of wealth spread around the world. Monetary policy can tighten or expand (print) the total amount of wealth in the world. When global liquidity is squeezed (interest rates go up, QT, etc.), usually you see a rotation of wealth into risk-off assets (Cash & short-term T-bills, Gold, “Stable” reserve currencies).

At this time, bitcoin is considered a risk-on asset (Due to its young lifespan) AND ONLY HOLDS AROUND 2 TRILLION DOLLARS TOTAL IN GLOBAL LIQUITIY (yes, I think it is undervalued). If we see severe global liquidity crises for an extended amount of time, this could impact bitcoins price dramatically.

This imagine is not mine, it is used on X frequently. I am not sure who the original owner of this image is. Up to date: Bitcoin is now 2T and Gold is around 20T - there is already a shift in global wealth and its just the start of the transition.

2. User Error and Custody Failures

Ironically, people losing their private keys or trusting the wrong institutions is a bigger threat to individual holders than anything external.

The best example of this is Sam Bankman-Fried, founder of FTX, secretly funneled billions of dollars in customer deposits into his hedge fund, Alameda Research, to cover losses, make risky bets, and fund lavish spending. He presented FTX as a safe, liquid exchange while using hidden back-end systems to bypass safeguards and mislead investors, partners, and users. When customers tried to withdraw funds in November 2022, the fraud collapsed because the money simply wasn’t there, triggering one of the largest financial scandals in crypto history. There are plenty of healthy bitcoin companies that I could recommend and may write an article about soon.

There are enough products now, that custodying your bitcoin can be a seamless experience. With that being said, it is still a risk to the user and each investor is responsible for understanding how to hold it. In time, you will see that the banking system is changing to include bitcoin as a type of investment/asset and there will be more options to store your coins. (Nothing beat cold storage.)

3. Mis-timed Selling

The #1 risk for most investors isn’t Bitcoin collapsing, it’s selling too much too early, then watching it climb multiples higher. It will not be up and to the right for the next two decades, but if you can hold through the dips, you will see how this asset class is changing finance.

Bitcoin doesn’t fail because of math, technology, or geopolitics. It fails for individuals when they panic, overtrade, or mismanage conviction.

4. Quantum Computing

Quantum computing could one day become powerful enough to break the cryptographic math that protects Bitcoin wallet addresses, meaning a hacker could theoretically figure out the private key that controls someone’s coins. Today, this isn’t possible, quantum computers are nowhere near strong enough, but future advances could make older, reused Bitcoin addresses more vulnerable. The risk is mainly that if someone sends Bitcoin from an address and exposes its public key, a future quantum attacker might be able to crack it if Bitcoin hasn’t upgraded by then. The good news is the Bitcoin network can switch to quantum-resistant cryptography long before quantum computers become a real threat, and users can protect themselves simply by not reusing addresses. This number is up in the air, but experts like NVIDA expect this to be a real threat by 2040.

And realistically, if quantum computing ever becomes strong enough to break Bitcoin, it will also be powerful enough to break the encryption that protects traditional banks, online accounts, and nearly every digital system we use today.

The Mythical Threats That Don’t Actually Matter

A Fiscal Miracle in Washington

The idea that the U.S. government becomes “profitable” again and maintains a perfectly strong, non-inflated dollar sounds nice in theory, but it’s mathematically incompatible with current debt levels, entitlement spending, and the structural deficit. Bitcoin does not rely on the decline of the U.S. dollar; it relies on the permanence of fiscal reality.

Since the U.S. fully left the gold standard in 1971, the dollar has steadily lost purchasing power due to inflation and continuous expansion of the money supply. Compared to hard assets like gold, the dollar has lost over 99% of its value, meaning what $1 bought in 1971 now costs $25–30 or more today. This decline isn’t because the dollar “collapsed” overnight but because the system is designed to devalue slowly over time to support borrowing, government spending, and credit growth. While the dollar remains dominant globally, its long-term trend shows that holding cash is a guaranteed loss of real wealth, pushing people toward assets that can’t be printed.

Gold Front-Running Bitcoin

Some argue that precious metals will reclaim their old role as the go-to asset during instability. Historically, however, gold moving upward signals falling real yields, which is bullish for Bitcoin. The two assets often rise together. Gold’s strength doesn’t weaken Bitcoin; it validates the macro environment that fuels it.

Bitcoin outperforms gold in several key ways: it’s perfectly scarce with a fixed 21 million supply, instantly verifiable by anyone, and far more portable since it can be moved globally in minutes. It’s easily divisible into tiny units, fully auditable on a public ledger, and resistant to theft or confiscation when secured properly. Unlike gold, which requires trust, storage, and physical handling, Bitcoin functions as a borderless, transparent, and tamper-proof form of money built for the digital age.

The Real Conclusion: Bitcoin Has Outgrown Existential Threats

Bitcoin is no longer a fragile startup trying to survive. It’s a global monetary asset with:

the strongest computing network on the planet,

global regulatory acceptance,

public companies and sovereigns holding it,

and structural demand built into ETFs, miners, and long-term holders.

The “death threats” being discussed today sound dramatic, but they don’t withstand scrutiny. The risks that matter now are macro timing, regulation, liquidity, and human behavior — not protocol failure.

Bitcoin isn’t unbreakable, but it is un-killable. The only real question left is how quickly the world adapts to what it already is.

About the Author

Macey Hollenshead is the founder of NextEdge Strategies, a consulting and research firm focused on digital assets and macro innovation at the intersection of AI and finance.

This content is for educational purposes only and does not constitute financial advice. Markets carry risk; consult licensed experts before making decisions.