The Future is Energy: How to Monetize it

Why “energy is the currency” is becoming the story of this decade — and beyond

The problem you feel every day: money feels weaker, energy feels more important

Most people don’t need charts or economic reports to know something has changed.

Groceries cost more. Housing feels harder to afford. Even when markets hit “all-time highs,” everyday life feels tighter. The common thread behind nearly all of it is energy.

Energy powers food production, transportation, heating, cooling, and now AI and the digital world. For decades, we treated money as the starting point of the economy. Trends are heading toward energy being the real foundation of value. Energy isn’t just a cost anymore. it’s becoming the currency. Try living in a home without energy, starting a business without energy, or even using your cell phone. All humans and entities need energy for survival.

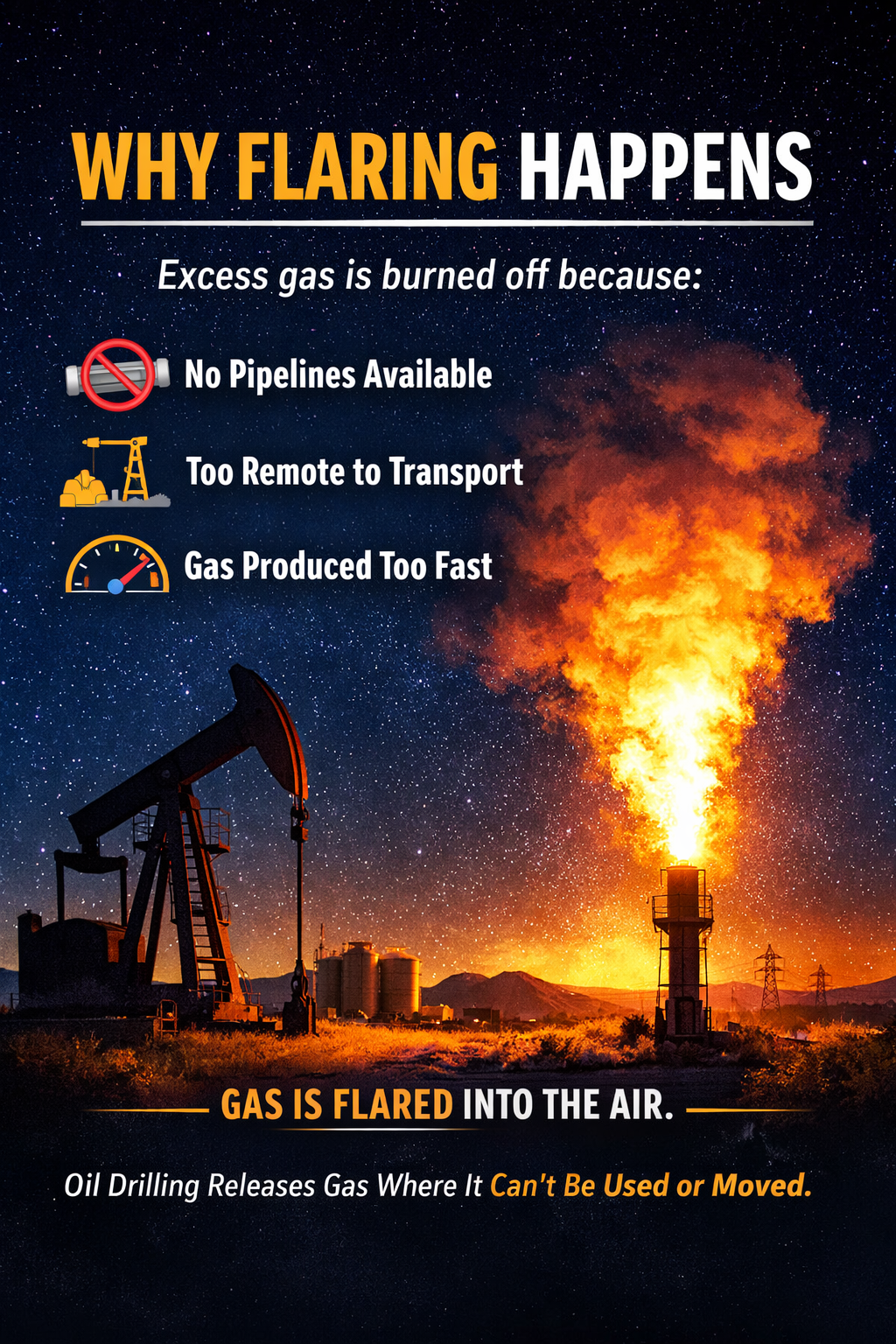

Energy waste tells a bigger story — and North Dakota proves it

In North Dakota, massive oil fields burn natural gas day and night.

Not because the energy isn’t valuable but because it can’t be easily transported. There’s no nearby pipeline. No immediate buyer. So, the gas is flared into the air. (Flaring burns unused natural gas from oil wells because oil wells produce gas faster than it can be transported)

That’s real economic value literally disappearing. This isn’t unique to North Dakota. Around the world, energy is wasted because it’s produced:

In the wrong place

At the wrong time

Without infrastructure to move it

This is where trends begin to shift. Bitcoin allows excess energy to be converted into a digital asset that can be saved and moved anywhere. Instead of energy being trapped by geography, it becomes portable. Globally, up to two-thirds of primary energy is lost through conversion, distribution, and underutilization; with large portions stranded or flared in remote areas. Source: Our World in Data

That reality is why more people are starting to say energy is the currency, and Bitcoin is one way to store it.

Bitcoin mining as a grid stabilizer: beyond waste, toward efficiency

One underappreciated angle is how Bitcoin mining can actively stabilize power grids. Miners often locate near renewable sources like Hydroelectric dams, Wind farms, and Solar installations. These sources frequently generate excess energy that would otherwise be curtailed (shut off to avoid overload). In Texas, for example, Bitcoin mining operations have partnered with utilities to:

Absorb surplus wind power during off-peak hours

Shut down instantly during peak demand

Reduce grid stress and volatility

This turns intermittent renewables into reliable revenue streams, accelerating clean energy buildout without subsidies. Rather than competing with the grid, Bitcoin mining can act as a flexible demand layer.

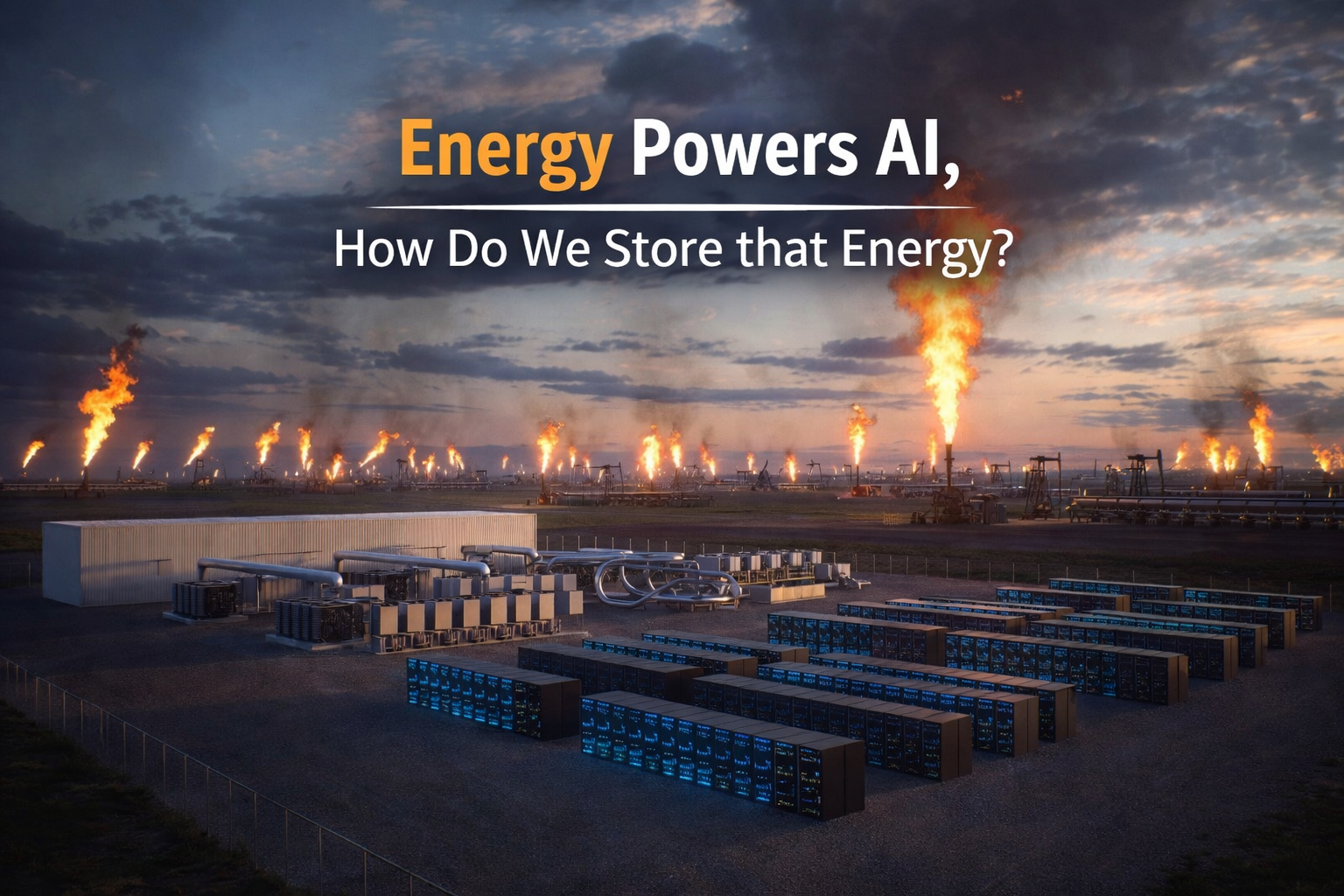

Data centers are the new factories — and they run on electricity

In the past, factories defined economic power.

Today, data centers power: Internet Searches, Payment Processors, Video streaming, and AI interaction. All of these processes flow through buildings filled with servers. And those servers have one overwhelming requirement: electricity.

AI has dramatically accelerated this trend. It’s changing how people work, learn, shop, and communicate — much like the internet did in the early 2000s.

But AI doesn’t run on ideas alone.

It runs on power.

Global data center electricity demand is projected to roughly double by 2030 — from ~450 TWh to nearly 1,000 TWh — driven largely by AI and cloud computing.

Source: International Energy Agency (IEA)

As data centers multiply, energy becomes more valuable, more strategic, and more contested.

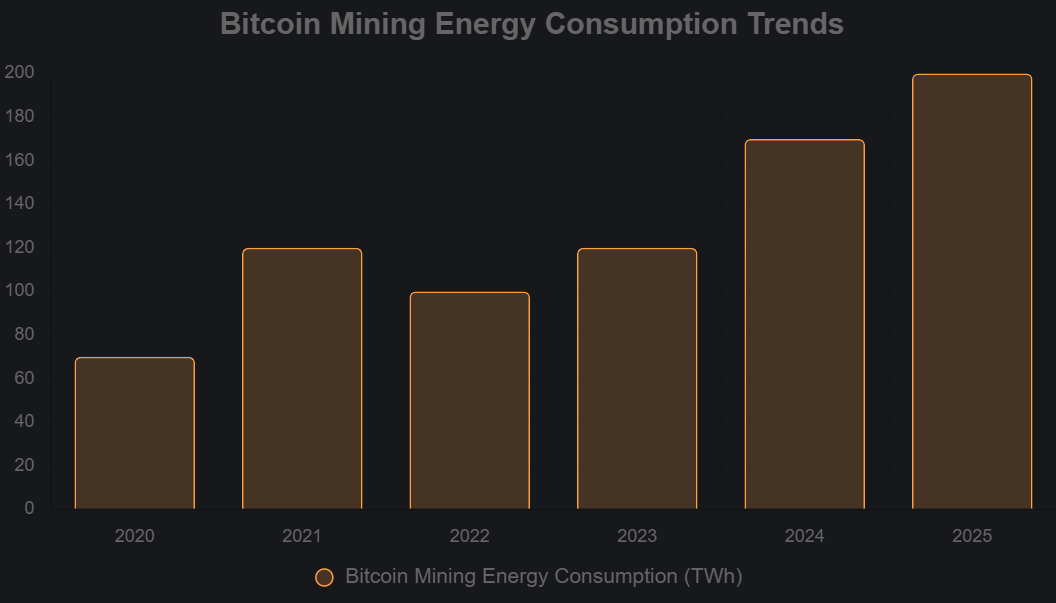

*** Why AI and Bitcoin are increasingly part of the same trend

At first glance, AI and Bitcoin seem unrelated.

One is about intelligence. The other is about money. Step back, and the connection becomes clear:

AI dramatically increases electricity demand

Data centers expand to meet that demand

Power grids face new strain

Energy becomes more valuable over time

Bitcoin fits into this shift as a system built for a digital, energy-intensive world.

Critics often point to Bitcoin’s energy use as a flaw. But this misses a key point:

Proof-of-work ensures that Bitcoin’s value is backed by real-world energy expenditure; making it scarce, secure, and resistant to manipulation in a way fiat currencies aren’t.

Unlike AI data centers, which consume power continuously, Bitcoin mining is flexible; capable of ramping down during peak grid demand to prioritize other uses.

If the internet changed how we communicate, AI is changing how we live, and Bitcoin reflects how value moves in that world.

This isn’t hype. It’s infrastructure.

What this means for everyday Americans with savings and investments

You don’t need to be a professional investor to understand the takeaway.

Trends are heading toward:

Higher long-term energy demand

More data centers and digital infrastructure

Greater competition for reliable power

Money systems that exist fully online

Bitcoin sits at the intersection of these forces. That doesn’t make it risk-free. Nothing is. But it helps explain why Bitcoin keeps returning to the conversation… even after crashes, skepticism, and regulation.

A note on risk: Bitcoin’s energy-backed model offers resilience, but it still faces:

Regulatory uncertainty

Technological disruption

Market volatility

Conclusion: energy is the currency — and Bitcoin reflects the direction of the world

Every major economic era is defined by how it uses energy.

Coal powered the industrial age

Oil powered transportation and globalization

Electricity powered the digital age

Now we’re entering an era where energy, computation, and money are tightly connected.

Bitcoin isn’t just a trade. It’s a reflection of where the world is heading; toward energy as the true store of value.

Next step:

Instead of asking “Should I buy Bitcoin?”, ask a better question:

How do I protect my savings in a world where energy defines economic power?